Renters Insurance in and around Lafayette

Welcome, home & apartment renters of Lafayette!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

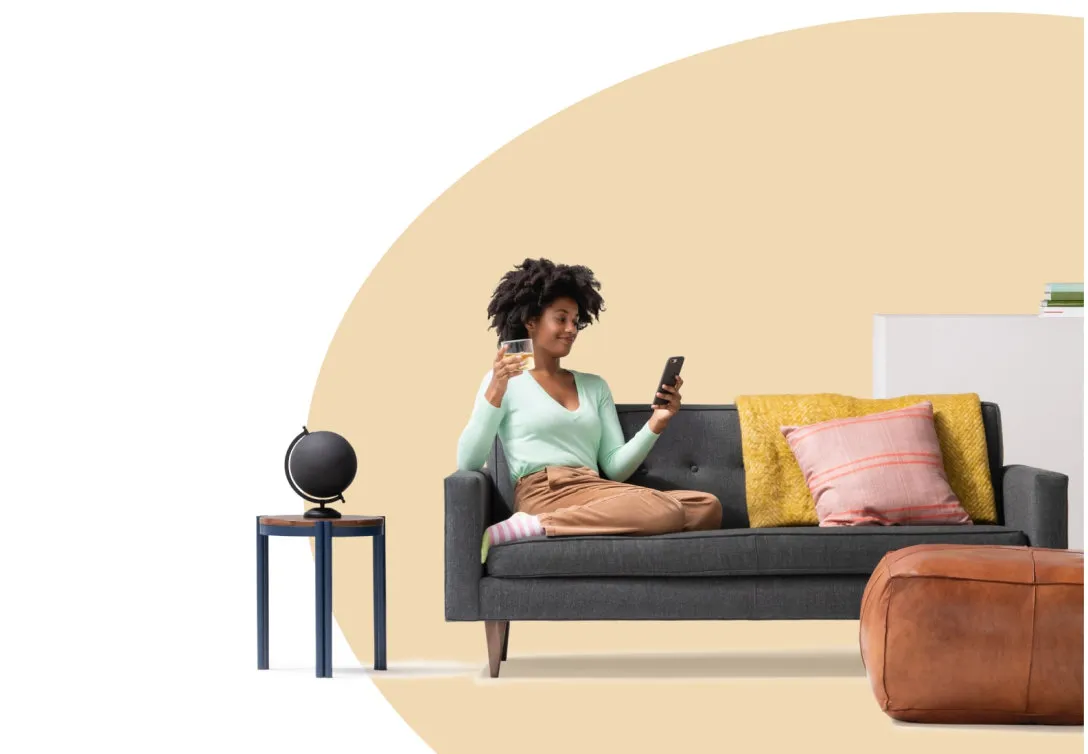

Home Is Where Your Heart Is

No matter what you're considering as you rent a home - number of bedrooms, furnishings, outdoor living space, house or apartment - getting the right insurance can be important in the event of the unpredictable.

Welcome, home & apartment renters of Lafayette!

Rent wisely with insurance from State Farm

Why Renters In Lafayette Choose State Farm

The unpredictable happens. Unfortunately, the possessions in your rented condo, such as a set of favorite books, a video game system and a coffee maker, aren't immune to vandalism or fire. Your good neighbor, agent Kelley Reed, is ready to help you choose the right policy and find the right insurance options to insure your precious valuables.

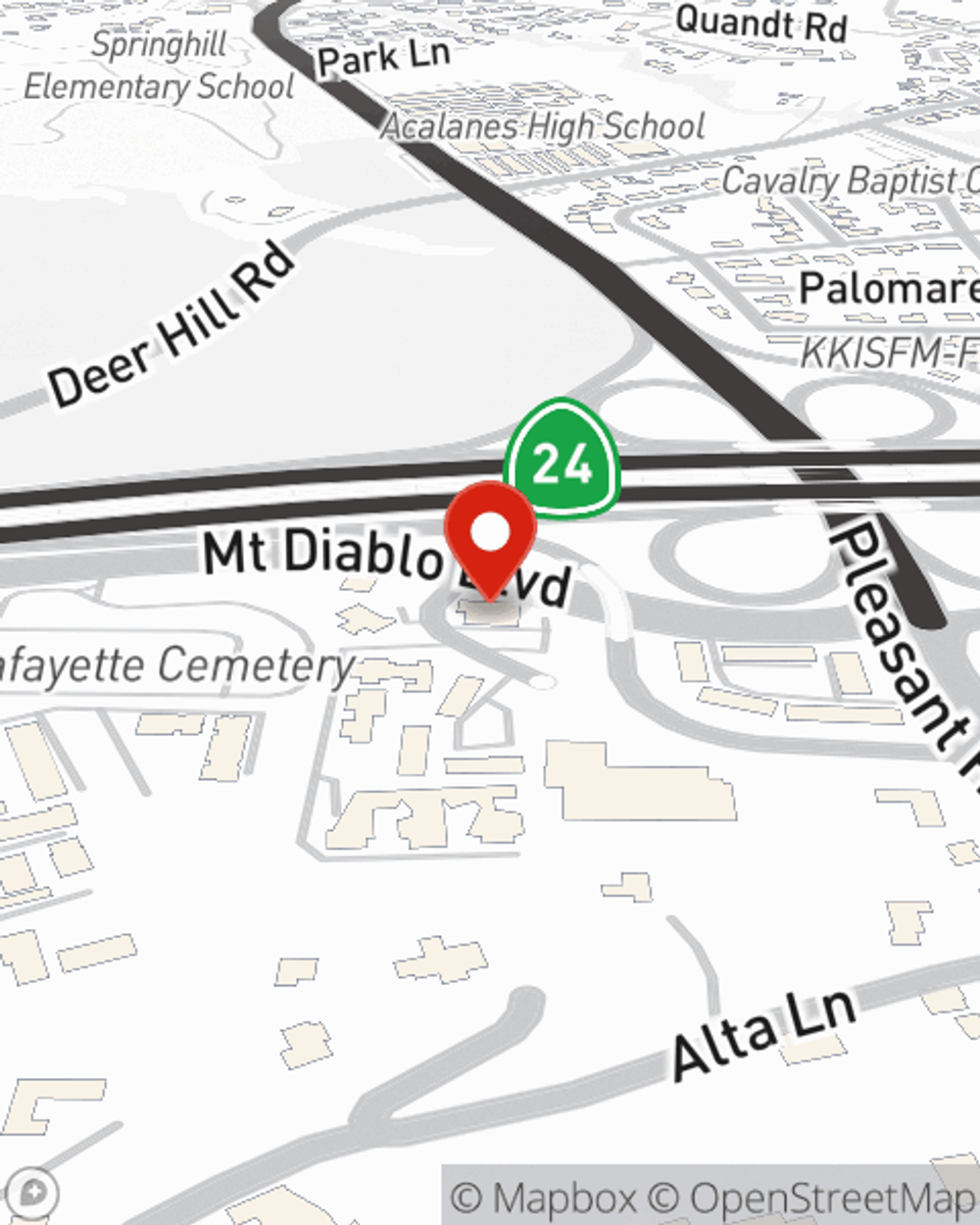

Renters of Lafayette, State Farm is here for all your insurance needs. Visit agent Kelley Reed's office to get started on choosing the right policy for your rented townhome.

Have More Questions About Renters Insurance?

Call Kelley at (925) 820-6808 or visit our FAQ page.

Simple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Kelley Reed

State Farm® Insurance AgentSimple Insights®

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.