Life Insurance in and around Lafayette

Protection for those you care about

What are you waiting for?

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

It can be what keeps you going every day to take care of your family, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can maintain a current standard of living and/or pay for college as they face the grief and pain of your loss.

Protection for those you care about

What are you waiting for?

Why Lafayette Chooses State Farm

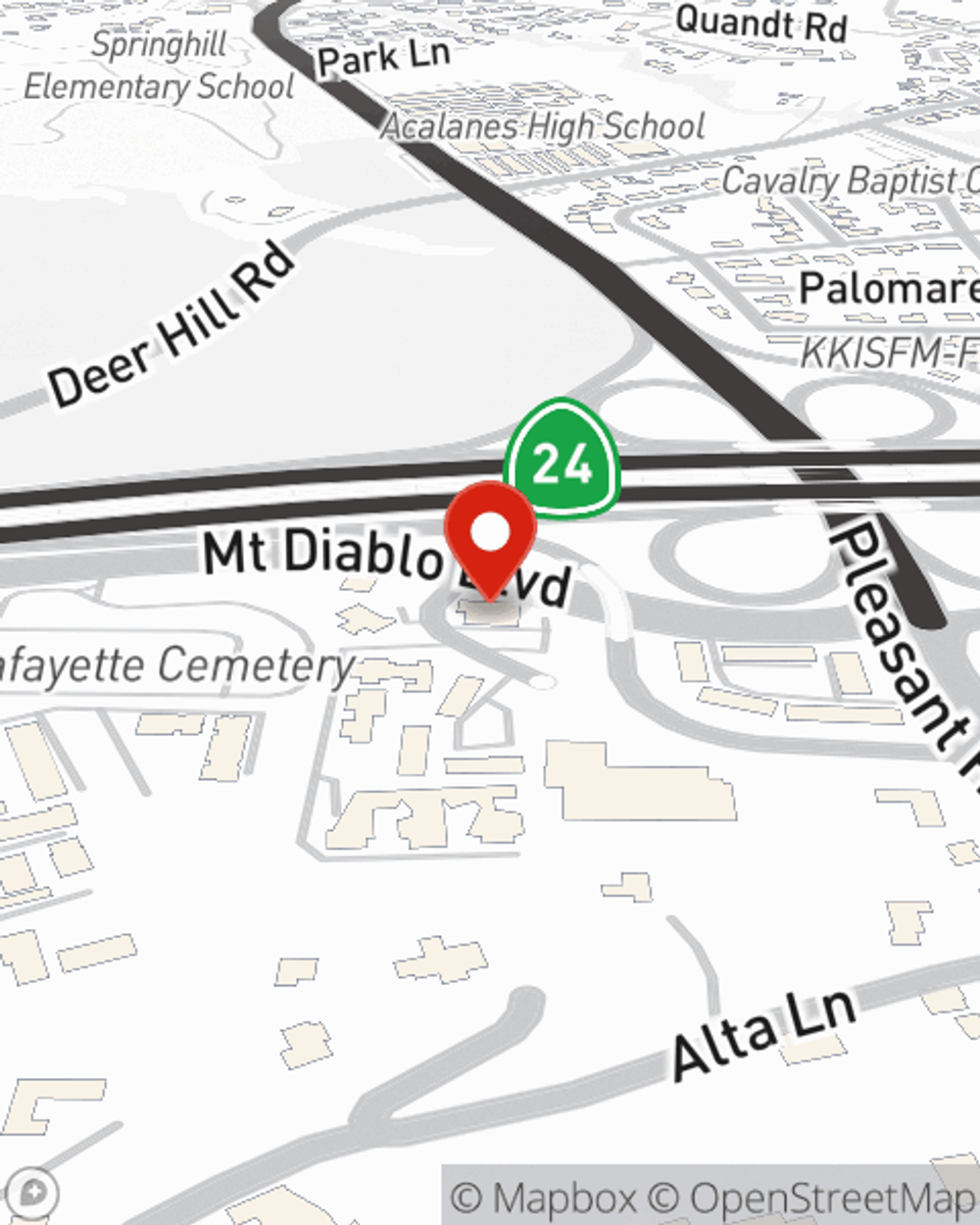

And State Farm Agent Kelley Reed is ready to help design a policy to meet you specific needs, whether you want coverage for a specific number of years or level or flexible payments with coverage designed to last a lifetime. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

Interested in checking out what State Farm can do for you? Contact agent Kelley Reed today to get to know your specific Life insurance options.

Have More Questions About Life Insurance?

Call Kelley at (925) 820-6808 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Kelley Reed

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.